- Home

- Who we are

-

What we do

- Cultural heritage

- Regional arts

- Arts and Disability

- Creative Australia

-

Indigenous arts and languages

- Australian Delegation to the Festival of Pacific Arts 2016

- ILA Program logos

- Indigenous Languages and Arts program

- Indigenous Visual Arts Industry Support program

- International Decade of Indigenous Languages

- National Indigenous Languages Convention

- Protecting First Nations traditional knowledge and traditional cultural expressions

- Review of the Indigenous Art Code

- Literature

- Ministerial Intergovernmental Engagement

-

Museums, libraries and galleries

- Alt text for National Cultural Institution Key Performance Indicator Infographics 2021–22—results and trends

- Australian Government International Exhibitions Insurance Program

- Impact of our National Cultural Institutions

- National Cultural Institution KPI Infographics 2020–21—results and trends (including text version)

- Significance 2.0

- The National Collecting Institutions Touring and Outreach program

- National Cultural Policy

- Performing arts

- Screen

- Visual arts

- Have your say

- Funding

- Publications

- News

Almost 3,000 artists have benefitted from the Scheme since 2010.

Under the Australian Government's Resale Royalty Scheme visual artists are entitled to a percentage of the price of eligible artworks which are resold commercially for $1,000 or more in Australia.

Changes introduced earlier this year mean that Australian artists can now also receive royalties when their eligible artworks are resold in 17 countries that have entered into reciprocal arrangements with Australia.

Almost 3,000 artists have benefitted from a share in $15 million in royalties from the 33,000 eligible resales over the life of the scheme so far. Around 65 per cent of artists benefitting from the scheme are First Nations artists.

One of the beneficiaries, Australian artist Laura Jones, said:

'The Resale Royalty Scheme recognises the ongoing effort it takes for artists to maintain a creative practice. Artworks take on a life of their own after they leave the studio, and so I think the scheme is wonderful because it ensures artists benefit from that growth as well… It's so important that artists exercise their copyright in their work, just like other creative industries.'

The Resale Royalty Scheme is administered by the Copyright Agency in Australia.

Funding programs

Latest news

Visions of Australia getting shows on the road

Seven organisations will share in up to $1.3 million in program funding.

Funding available for arts activities at regional and remote festivals

Round 21 of the Festivals Australia program is now open, with over $700,000 available to support arts projects delivered in regional and remote areas.

Festivals Australia program bringing together past, present and future

Over $700,000 will be shared amongst successful projects through round 20.

New research sheds light on creative workplaces

New research has investigated how Australia’s creative workforce and economy can best be supported to thrive and create lifelong careers in the arts sector.

Have your say

Arts and Screen Employment Pathways Pilot Program

We invited feedback on the development of the new Arts and Screen Employment Pathways Pilot Program to support d/Deaf and disabled artists and arts workers. This consultation is closed.

Review of the Indigenous Art Code

A review of the Indigenous Art Code is underway to strengthen the protections for Indigenous artists and consumers across the country. This consultation is closed.

Revive: a place for every story, a story for every place

After extensive national consultation, in 2023 we delivered a 5 year national cultural policy, Revive—A place for everyone story, a story for every place.

National Opera Review

The Australian Government has released a full response to the recommendations of the National Opera Review final report, which examined the artistic vibrancy, financial viability and accessibility of Australia’s major opera companies.

Latest consultations

Funding programs

What's new

Sharing more treasures from the National Collection

Eight regional Australian communities are finding new inspiration from artworks on loan from the National Gallery of Australia.

Bringing international art to Australia with funding to help with insurance costs

The 2026–27 round of the Australian Government International Exhibitions Insurance program (AGIEI) is now open to applications.

Applications now open for funding of regional and remote arts projects

Round 22 of the Festivals Australia program is open to applications for arts projects at festivals and community events in regional and remote Australia.

Funding available for new arts and cultural touring exhibitions

Arts and cultural organisations can now apply for Round 22 of the Visions of Australia funding program.

Support programs

Displaying 51 - 60 of 243

Support for festivals across Australia

Regional and remote festivals set to benefit from the latest round of funding.

New exhibitions to tour Australia

Communities across the country will be able to enjoy fascinating new touring exhibitions through the latest round of the Australian Government’s Visions of Australia program.

Video series highlights harm caused by fake First Nations art

In this video series, First Nations artists and industry workers share their experiences with the effect fake art has had on First Nations artists and their communities.

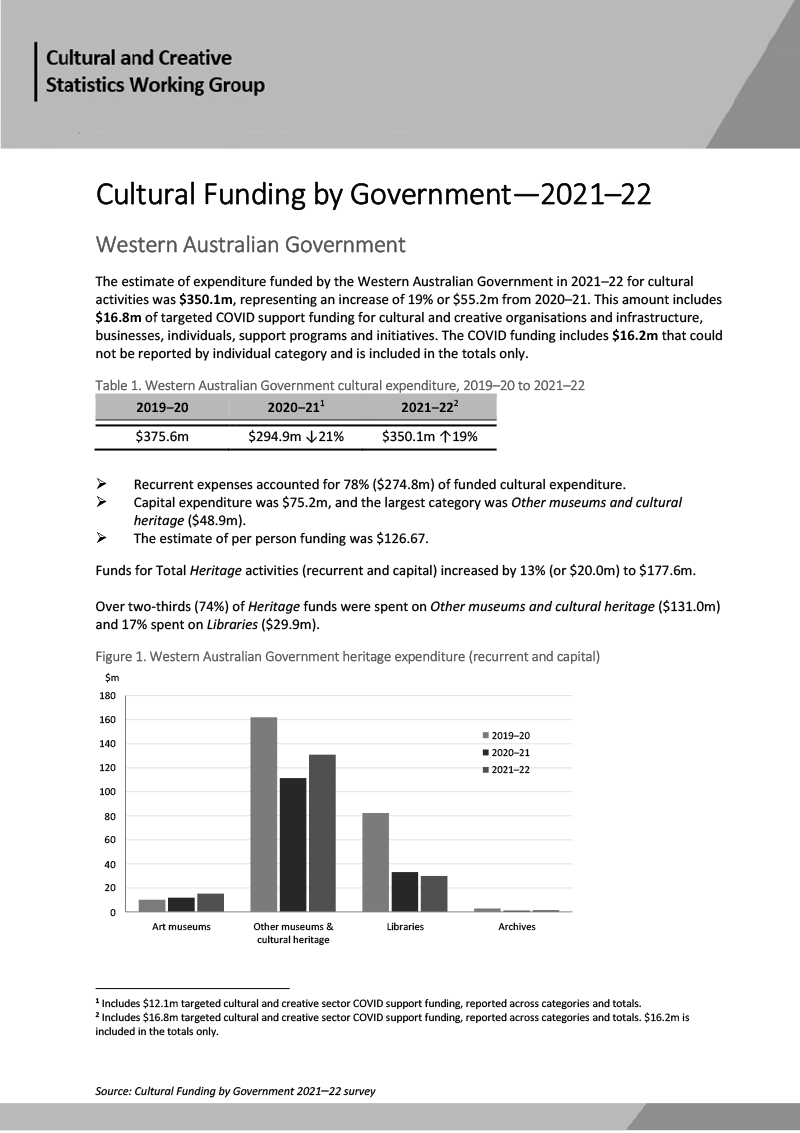

Highlighting the value of our cultural and creative activity

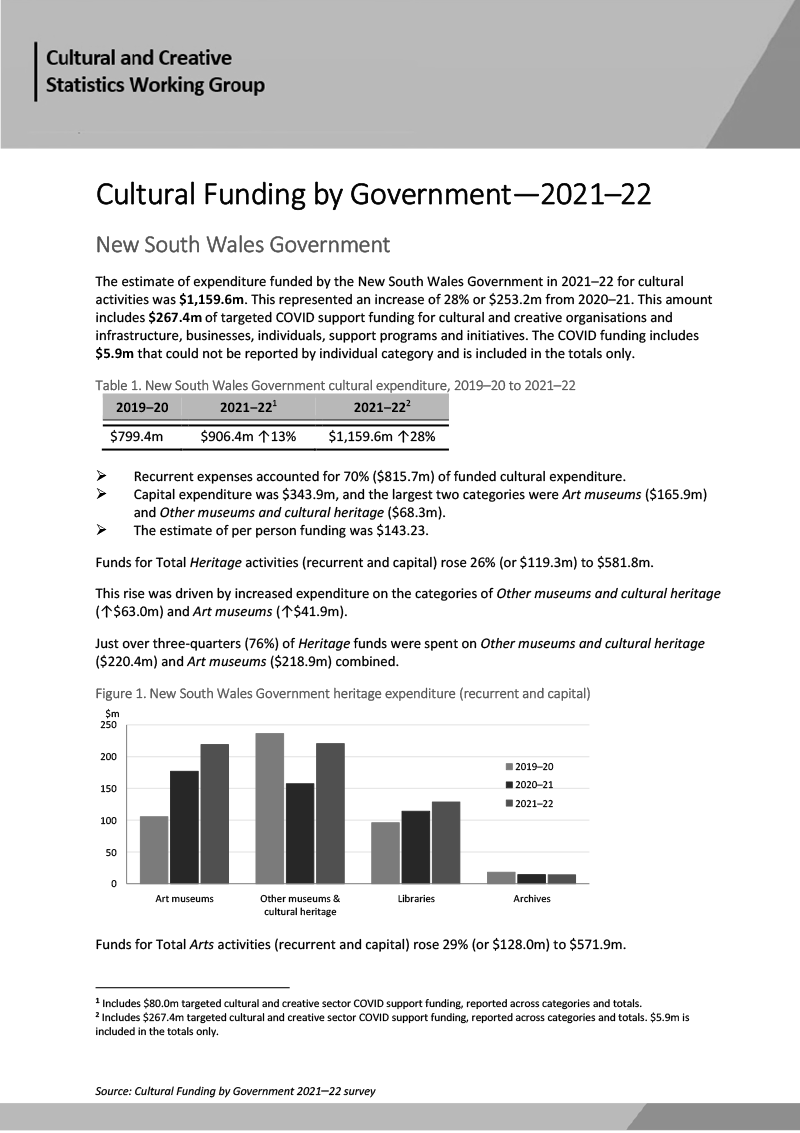

The Australian Government has today released two reports highlighting the significant contribution the cultural and creative sector is making to the economy and examining its trends post-COVID.

What's on: Summer 2025

Visit an art gallery or museum this summer and school holidays to beat the heat and keep everyone entertained.

Five First Nations ancestors welcomed home from Berlin

A handover ceremony was held at the Ethnological Museum in Berlin, Germany on 5 December 2024.

International Day for People with Disability 2024

Take action to increase equity, inclusion and representation for people with disability.

Setting the path for equity in the arts

A newly released plan, Equity: the Arts and Disability Associated Plan, will support the arts, cultural, screen and digital games sectors to achieve greater equity for artists, arts workers and audiences with disability.

App unlocks ancient stories of Mungo National Park

Visitors can now explore the rich Aboriginal history of Mungo National Park thanks to a new app, Mungo Stories: Walk Together.

New arts projects in regional and remote Australia

84 arts projects will share in over $1.7 million thanks to the Regional Arts Fund.

Support programs

Funding programs

No results found.

Displaying 61 - 72 of 356

Support programs

Sign up

Sign up for news and updates from our agency.

Sign up to ART/works

Displaying 51 - 60 of 820

Cultural Gifts Program—Nomination of a Valuer

Published: 22 Jul 2022 Cultural gifts program—nomination of a valuer—Section 30-210 of the Income Tax Assessment Act 1997. cultural-gifts-program-nomination-of-valuer-july2022.docx (DOCX, 105.68 KB) …

PublicationCultural Gifts Program—Valuer referee report

Published: 22 Jul 2022 Cultural gifts program—valuer referee report—Section 30-210 of the Income Tax Assessment Act 1997 . cultural-gifts-program-valuer-referee-report-july2022.docx (DOCX, 214.23 KB) …

PublicationVisions of Australia Venue Confirmation Form

Published: 9 Sep 2016 This form is required to be completed by the venue director or manager for each venue. venue_confirmation_form.pdf (PDF, 358.24 KB) venue_confirmation_form.pdf (PDF, 358.24 KB) … 364 … 365 … 366 … 10 … Visions of Australia Venue …

PublicationChecklist for new valuer applications

Published: 27 Jun 2019 This checklist is designed for valuers preparing documentation to gain approved status under the Cultural Gifts Program. cgp-valuer-checklist-for-new-valuer-applications.docx (DOCX, 743.62 KB) …

PublicationFrequently Asked Questions - Visions of Australia

Published: 9 Sep 2016 FAQ covering funding, eligibility, assessment criteria, application and assessment process, privacy and complaints mechanism. frequently_asked_questions_mh.docx (DOCX, 754.43 KB) frequently_asked_questions_mh.pdf (PDF, 568.62 KB) … …

PublicationCultural Gifts Program—One-off approval for a valuer to value items outside approved classes

Published: 22 Jul 2022 Information for valuers seeking a one-off extension to the classes of item they are approved to value for the purposes of providing a valuation for a specific donation. …

PublicationCultural Gifts Program—Code of conduct for valuers

Published: 22 Jul 2022 This Code of Conduct governs valuers approved under the Cultural Gifts Program. The Code is consistent with, and supplements, the Cultural Gifts Program Guide issued by the Department of Infrastructure, Transport, Regional …

PublicationCultural Gifts Program—Valuer Private Interests Assurance

Published: 22 Jul 2022 Section 30–210 of the Income Tax Assessment Act 1997 cultural-gifts-program-valuer-private-interests-assurance.docx (DOCX, 218.73 KB) cultural-gifts-program-valuer-private-interests-assurance.pdf (PDF, 233.77 KB) … 379 … 380 … 381 …

PublicationValuation certificate checklist

Published: 27 Jun 2019 This checklist is to assist approved valuers who are preparing valuations for donations submitted under the Cultural Gifts Program (CGP). cgp-checklist-for-completing-a-valuation-certificate.docx (DOCX, 744.19 KB) …

PublicationGuidelines for valuing entomological (insect) collections

Published: 27 Jun 2019 These guidelines should be referred to when valuing donations of entomological material under the CGP. cgp-guidelines-for-valuing-entomological-insect-collections.docx (DOCX, 744.67 KB) …

PublicationFunding and support program archive

No results found.