- Home

- Who we are

-

What we do

- Cultural heritage

- Regional arts

-

Arts and Disability

- Arts Accessibility

- Arts and Screen Employment Pathways Pilot Program

- Equity: the Arts and Disability Associated Plan

- Implementation Advisory Group for Equity: the Arts and Disability Associated Plan

- Implementation Advisory Group for Equity—Expression of Interest process

- Publications and resources

- Helpful links

- Support at work

- Creative Australia

-

Indigenous arts and languages

- Australian Delegation to the Festival of Pacific Arts 2016

- Australian Government Action Plan for the 2019 International Year of Indigenous Languages

- ILA Program logos

- Indigenous Languages and Arts program

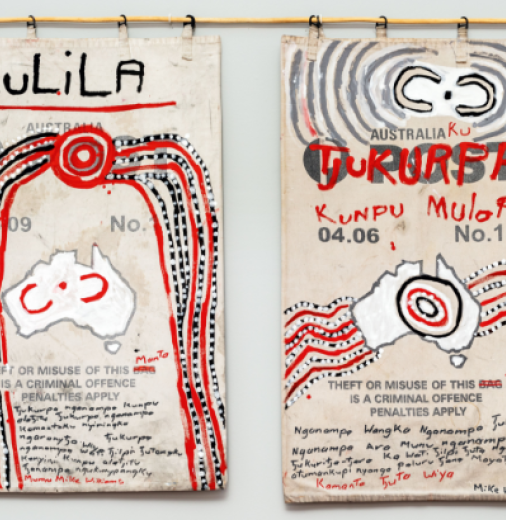

- Indigenous Visual Arts Industry Support program

- International Decade of Indigenous Languages

- National Indigenous Languages Convention

- Review of the Indigenous Art Code

- Stand-alone Indigenous Cultural and Intellectual Property Legislation

- Literature

- Ministerial Intergovernmental Engagement

-

Museums, libraries and galleries

- Alt text for National Cultural Institution Key Performance Indicator Infographics 2021–22—results and trends

- Australian Government International Exhibitions Insurance Program

- Impact of our National Cultural Institutions

- National Cultural Institution KPI Infographics 2020–21—results and trends (including text version)

- Significance 2.0

- The National Collecting Institutions Touring and Outreach program

- National Cultural Policy

- National Indigenous Visual Arts Action Plan 2021–25

- Performing arts

- Screen

- Visual arts

- Have your say

- Funding

- Publications

- News

In changes announced today the Producer Offset will now include long-form drama series.

Changes to the Producer Offset will help create more Australian stories on our screens by allowing more access for producers of Australian feature films, television and other projects.

The Producer Offset gives a tax rebate to producers for expenditure on eligible Australian films, television and other projects. Currently, a drama series must spend at least $500,000 per hour in qualifying Australian production expenditure (QAPE)—that is, expenditure incurred for goods and services used or provided in Australia.

With the new threshold, drama series that spend at least $35 million per season in QAPE will be eligible for the offset. This change will benefit any drama series that films significant numbers of hours over a season but does not meet the per hour threshold—meaning more drama productions will be able to access a rebate.

The new threshold will apply to productions that commence principal photography or production of the animated image on or after 1 July 2024.

More information about the Producer Offset can be found on the Screen Australia producer offset page.

Funding programs

Latest news

New Australian content laws for streaming services

The laws will bring more Australian stories to our screens and support the local screen industry.

New research sheds light on creative workplaces

New research has investigated how Australia’s creative workforce and economy can best be supported to thrive and create lifelong careers in the arts sector.

Supporting the Australian screen sector

Legislation passed by Parliament makes important changes to the Location Offset and the Producer Offset.

Funding strengthens the arts at country festivals

Festivals across regional and remote Australia will receive funding to connect audiences and communities.

Have your say

Arts and Screen Employment Pathways Pilot Program

We invited feedback on the development of the new Arts and Screen Employment Pathways Pilot Program to support d/Deaf and disabled artists and arts workers. This consultation is closed.

Review of the Indigenous Art Code

A review of the Indigenous Art Code is underway to strengthen the protections for Indigenous artists and consumers across the country. This consultation is closed.

Revive: a place for every story, a story for every place

We developed a national cultural policy for the next 5 years following extensive consultation.

National Opera Review

The Australian Government has released a full response to the recommendations of the National Opera Review final report, which examined the artistic vibrancy, financial viability and accessibility of Australia’s major opera companies.

Latest consultations

Funding programs

What's new

The power of stories

Australian author and journalist Trent Dalton chats all things books, life and lending rights.

Interim report shows resilience of cultural and creative workforce

Research shows strong growth for sector from 2008–09 to 2023–24.

Visions of Australia getting shows on the road

Seven organisations will share in up to $1.3 million in program funding.

Boost for arts projects in regional and remote Australia

A total of 77 arts projects will share in over $1.7 million thanks to the latest round of Regional Arts Fund Project Grants.

Support programs

Displaying 31 - 40 of 238

Language is key in delivering healthy teeth practices

A pilot project teaching dental health practices to First Nations children in language has shown to improve oral health speech and literacy.

Support the rollout of Equity: the Arts and Disability Associated Plan

Expressions of Interest are now open to join the Implementation Advisory Group for Equity.

New touring exhibitions telling stories of Country

Round 20 of the Visions of Australia program is delivering $1.4 million towards 5 new touring exhibitions.

New research sheds light on creative workplaces

New research has investigated how Australia’s creative workforce and economy can best be supported to thrive and create lifelong careers in the arts sector.

Resale Royalty expands for Australian artists

Australian artists are set to benefit when their works are resold overseas, with international reciprocity being extended to a further 9 countries.

Follow our new Instagram channel @AusGovArts

We've launched our Office for the Arts Instagram channel to bring you the latest news and updates about Australian arts and culture.

Artist profile: Lauren Rogers on fake art’s cost to culture

Ngarabul and Torres Strait Islander artist Lauren Rogers talks about the inappropriate use of First Nations artwork and its cost to culture.

Support for Indigenous languages and arts activities

First Nations community organisations that run language and arts activities will share in $30 million through the Indigenous Languages and Arts (ILA) program.

Holey Dollar returned to Poland

A 200-year-old silver coin has been returned to the Government of Poland.

Support for First Nations artists

First Nations-owned art centres, fairs, regional hubs and industry service organisations will share in $38 million through the Indigenous Visual Arts Industry Support (IVAIS) program.

Support programs

Funding programs

No results found.

Displaying 37 - 48 of 360

Support programs

Sign up

Sign up for news and updates from our agency.

Sign up to ART/works

Displaying 31 - 40 of 819

Indigenous Visual Arts Industry Support (IVAIS)—impacts of COVID-19

Published: 22 Apr 2020 This document contains responses to frequently asked questions we are hearing from IVAIS recipients. We will endeavour to update this document regularly pending developments with the Australian Government’s response to the evolving …

PublicationLocation offset glossary

Published: 4 Apr 2025 This Glossary is a combination of terminology and a general description of what is, and is not, considered qualifying Australian production expenditure (QAPE) for the Location Offset. Location Offset glossary—April 2025—PDF (PDF, …

PublicationILA program COVID-19 frequently asked questions

Published: 21 Apr 2020 ILA program COVID-19 frequently asked questions ila-covid-19-factsheet.docx (DOCX, 52.84 KB) ila-covid-19-factsheet.pdf (PDF, 188.97 KB) … 303 … 304 … 305 … 3 … ILA program COVID-19 frequently asked …

PublicationFestivals Australia October 2015 Round - Grant Recipients

Published: 31 Jan 2015 festivals-of-australia-grants-recipients-october-round-2015-16-2_0.docx (DOCX, 63.26 KB) festivals-of-australia-grants-recipients-october-round-2015-16-2_0.pdf (PDF, 451.38 KB) … 306 … 307 … 14 … 16 … Festivals Australia October …

PublicationThe Australian Government response to the Report on the impact of inauthentic art and craft in the style of First Nations peoples

Published: 3 Mar 2020 The Australian Government response to the House of Representatives Standing Committee on Indigenous Affairs: Report on the impact of inauthentic art and craft in the style of First Nations peoples. …

PublicationFestivals Australia grant recipients—National summary of projects—Round 9, September 2019

Published: 24 Jan 2020 List of national summary of projects for Round 9, September 2019. festivals_australia-grant-recipients_r9.docx (DOCX, 124.79 KB) festivals_australia-grant-recipients_r9.pdf (PDF, 172.72 KB) … 311 … 312 … 313 … 15 … 16 … Festivals …

PublicationArts Access Australia project accessibility plan

Published: 9 Aug 2016 Template to help check the accessibility of your event. arts_access_australia_project_accessibility_plan.docx (DOCX, 50.58 KB) arts_access_australia_project_accessibility_plan_0.pdf (PDF, 307.94 KB) … 314 … 315 … 316 … 52 … Arts …

PublicationAuspice arrangement confirmation form

Published: 20 Nov 2017 This form is to confirm the auspice arrangements that have been made. auspice-arrangement-confirmation-form.docx (DOCX, 751.57 KB) auspice-arrangement-confirmation-form.pdf (PDF, 210.13 KB) … 319 … 317 … 318 … 10 … Auspice …

PublicationFestivals Australia Frequently Asked Questions

Published: 9 Sep 2016 FAQ covering funding, eligibility, assessment criteria, application and assessment process, privacy and complaints mechanism. faqs-festivals-australia.docx (DOCX, 112.52 KB) faqs-festivals-australia.pdf (PDF, 585.67 KB) … 320 … 321 … …

PublicationFestivals Australia program guidelines

Published: 9 Sep 2016 The Australian Government provides approximately $1.2 million each financial year for the Festivals Australia program. Festivals Australia delivers two funding rounds usually closing in September and March each year. …

PublicationFunding and support program archive

No results found.