- Home

- Who we are

-

What we do

- Cultural heritage

- Regional arts

-

Arts and Disability

- Arts Accessibility

- Arts and Screen Employment Pathways Pilot Program

- Equity: the Arts and Disability Associated Plan

- Implementation Advisory Group for Equity: the Arts and Disability Associated Plan

- Implementation Advisory Group for Equity—Expression of Interest process

- Publications and resources

- Helpful links

- Support at work

- Creative Australia

-

Indigenous arts and languages

- Australian Delegation to the Festival of Pacific Arts 2016

- Australian Government Action Plan for the 2019 International Year of Indigenous Languages

- ILA Program logos

- Indigenous Languages and Arts program

- Indigenous Visual Arts Industry Support program

- International Decade of Indigenous Languages

- National Indigenous Languages Convention

- Review of the Indigenous Art Code

- Stand-alone Indigenous Cultural and Intellectual Property Legislation

- Literature

- Ministerial Intergovernmental Engagement

-

Museums, libraries and galleries

- Alt text for National Cultural Institution Key Performance Indicator Infographics 2021–22—results and trends

- Australian Government International Exhibitions Insurance Program

- Impact of our National Cultural Institutions

- National Cultural Institution KPI Infographics 2020–21—results and trends (including text version)

- Significance 2.0

- The National Collecting Institutions Touring and Outreach program

- National Cultural Policy

- National Indigenous Visual Arts Action Plan 2021–25

- Performing arts

- Screen

- Visual arts

- Have your say

- Funding

- Publications

- News

Funding programs

Latest news

Archaeological objects returned to Egypt

Seventeen Egyptian artefacts have been formally returned to the Government of the Arab Republic of Egypt in a handover held at the Australian Parliament House.

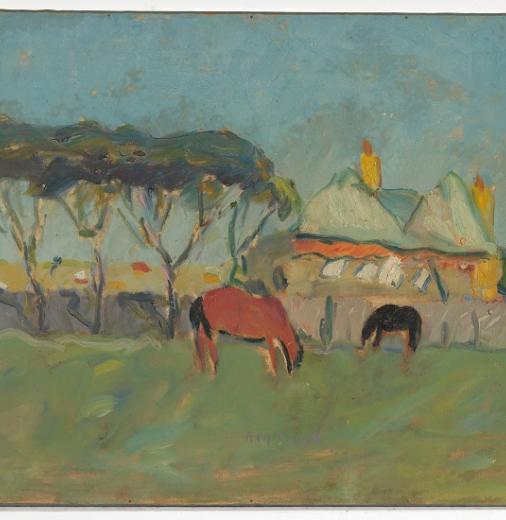

Bendigo Art Gallery acquires major Sidney Nolan painting

The gallery has acquired a significant 1962 painting by renowned Australian artist Sidney Nolan thanks to the National Cultural Heritage Account.

Funding available for arts activities at regional and remote festivals

Round 21 of the Festivals Australia program is now open, with over $700,000 available to support arts projects delivered in regional and remote areas.

Sir Donald Bradman’s Baggy Green the newest addition to the national collection

The National Museum of Australia has recently acquired the iconic cricketer’s cap with the help of the National Cultural Heritage Account.

Have your say

Arts and Screen Employment Pathways Pilot Program

We invited feedback on the development of the new Arts and Screen Employment Pathways Pilot Program to support d/Deaf and disabled artists and arts workers. This consultation is closed.

Review of the Indigenous Art Code

A review of the Indigenous Art Code is underway to strengthen the protections for Indigenous artists and consumers across the country. This consultation is closed.

Revive: a place for every story, a story for every place

We developed a national cultural policy for the next 5 years following extensive consultation.

National Opera Review

The Australian Government has released a full response to the recommendations of the National Opera Review final report, which examined the artistic vibrancy, financial viability and accessibility of Australia’s major opera companies.

Latest consultations

Review of the Protection of Movable Cultural Heritage Act

Shane Simpson AM finished a review of the Protection of Movable Cultural Heritage Act 1986 in 2015.

Funding programs

What's new

The power of stories

Australian author and journalist Trent Dalton chats all things books, life and lending rights.

Visions of Australia getting shows on the road

Seven organisations will share in up to $1.3 million in program funding.

Boost for arts projects in regional and remote Australia

A total of 77 arts projects will share in over $1.7 million thanks to the latest round of Regional Arts Fund Project Grants.

Celebrating Australia and Singapore’s cultural ties

We recently hosted a major meeting and arts industry forum in Adelaide to exchange ideas, stories, practices and experiences with Singapore.

Support programs

Displaying 1 - 10 of 237

The power of stories

Australian author and journalist Trent Dalton chats all things books, life and lending rights.

Visions of Australia getting shows on the road

Seven organisations will share in up to $1.3 million in program funding.

Boost for arts projects in regional and remote Australia

A total of 77 arts projects will share in over $1.7 million thanks to the latest round of Regional Arts Fund Project Grants.

Celebrating Australia and Singapore’s cultural ties

We recently hosted a major meeting and arts industry forum in Adelaide to exchange ideas, stories, practices and experiences with Singapore.

International Day of People with Disability 2025

Our work to support equitable access to the arts for people with disability is full steam ahead.

Arthur Boyd returns to Bundanon

The latest artwork loan under the Sharing the National Collection initiative shows that home is where the heart is.

New Australian content laws for streaming services

The laws will bring more Australian stories to our screens and support the local screen industry.

Archaeological objects returned to Egypt

Seventeen Egyptian artefacts have been formally returned to the Government of the Arab Republic of Egypt in a handover held at the Australian Parliament House.

Australia is alive with the sound of music

Live music in Australia is getting turned up through Revive Live grants.

More nationally significant artworks reach regional Australia

Five eastern Australian galleries will be loaned pieces from the national collection to share with regional and suburban communities.

Support programs

Displaying 1 - 5 of 5

Arts and Screen Employment Pathways Pilot Program

We invited feedback on the development of the new Arts and Screen Employment Pathways Pilot Program to support d/Deaf and disabled artists and arts workers. This consultation is closed.

Review of the Indigenous Art Code

A review of the Indigenous Art Code is underway to strengthen the protections for Indigenous artists and consumers across the country. This consultation is closed.

Revive: a place for every story, a story for every place

We developed a national cultural policy for the next 5 years following extensive consultation.

National Opera Review

The Australian Government has released a full response to the recommendations of the National Opera Review final report, which examined the artistic vibrancy, financial viability and accessibility of Australia’s major opera companies.

Review of the Protection of Movable Cultural Heritage Act

Shane Simpson AM finished a review of the Protection of Movable Cultural Heritage Act 1986 in 2015.

Funding programs

Displaying 1 - 12 of 12

Displaying 1 - 12 of 359

Support programs

Sign up

Sign up for news and updates from our agency.

Sign up to ART/works

Displaying 1 - 10 of 818

Bronze Age stone weight returned to Pakistan

An ancient stone weight of cultural significance was returned today to Pakistan. 8 Dec 2021 The stone weight was returned to HE Zahid Hafeez Chaudhri, High Commissioner of Pakistan at a ceremony which took place at the High Commission on 8 December 2021. …

NewsAxe heading home to the Philippines

A wood and steel axe of cultural significance has been returned to the Philippines. 19 Nov 2021 19 November 2021 The axe, which dates back to the early to mid 20th century, comes from the Igorot communities of northern Luzon, who still use this type of …

NewsPriceless Incan carving to head home

A priceless Incan carved wooden vessel, known as a canopa, will soon be on its way back to its rightful home in Peru. 4 Nov 2021 A carved Incan canopa that depicts two llamas. It has a rounded hollow on its back, where offerings were dedicated to the care …

NewsVictoria - Jurisdiction Profile

Published: 6 Feb 2018 The Victorian profile provides a comprehensive overview of arts and culture on a range of topics including participation in cultural activities, cultural funding by government, employment in culture, and attendances at cultural …

PublicationPost-Implementation Review — Resale Royalty Right for Visual Artists Act 2009 and the Resale Royalty Scheme

Published: 23 Dec 2019 The 2013 Report for the Post-implementation Review of the Resale Royalty Right for Visual Artists Act 2009 (the Act) and accompanying Scheme examines the first three years and four months of the Scheme's operation. The Report uses …

PublicationIndigenous Languages and Arts Program funded Indigenous Language Centres

Published: 1 Oct 2024 Indigenous Languages and Arts Program funded Indigenous Language Centres—September 2024—PDF (PDF, 411.7 KB) Indigenous Languages and Arts Program funded Indigenous Language Centres—September 2024—DOCX (DOCX, 952.58 KB) … 3121 … 3122 …

PublicationFestivals Australia September 2020 round 11—grant recipients

Published: 23 Dec 2020 List of national summary of projects for Round 11, September 2020. festivals-australia-grant-recipients-national-summary-of-projects-round-11september2020.docx (DOCX, 165.47 KB) …

PublicationIndigenous Languages and Arts (ILA) Program Frequently Asked Questions

Published: 15 Dec 2025 Tips for a competitive application and Frequently asked questions on the Indigenous Languages and Arts Program. Indigenous Languages and Arts (ILA) Program 2026–27—Open Competitive Grant Opportunity—FAQs—December 2025—PDF (PDF, …

PublicationRISE Fund grant recipients—Batch one summary of projects

Published: 22 Dec 2020 Recipients of the RISE Fund grant. rise-fund-grant-recipients-batch-one-summary-of-projects_0.docx (DOCX, 195.43 KB) rise-fund-grant-recipients-batch-one-summary-of-projects_0.pdf (PDF, 550.42 KB) … 235 … 236 … 237 … RISE Fund grant …

PublicationProject grants—recipients list, round 2, 2022

Published: 23 Nov 2022 project-grants-recipients-list-round-2-2022.docx (DOCX, 247.88 KB) project-grants-recipients-list-round-2-2022.pdf (PDF, 228.92 KB) … 238 … 239 … Project grants—recipients list, round 2, …

Publication