NCITO Program logos

The National Collecting Institutions Touring and Outreach (NCITO) program logo is used to acknowledge Australian Government support for activities funded under NCITO.

The program logo and/or wording below must be used by funding recipients on materials including, but not limited to, promotional materials, websites, invitations and signage.

If using the Australian Government logo, it must be used in line with the Australian Government logo guidelines on the Department of the Prime Minister and Cabinet website.

Note: the Australian Government crest must not be printed smaller than 20mm in width.

Acknowledgement text: 'This project has been assisted by the Australian Government's National Collecting Institutions Touring and Outreach program'.

Press ready logos

Inline regular

Inline reversed

Stacked regular

Stacked reversed

Web ready logos

Inline regular

Inline reversed

Stacked regular

Stacked reversed

Microsoft Office ready logos

Inline regular

Inline reversed

Stacked regular

Stacked reversed

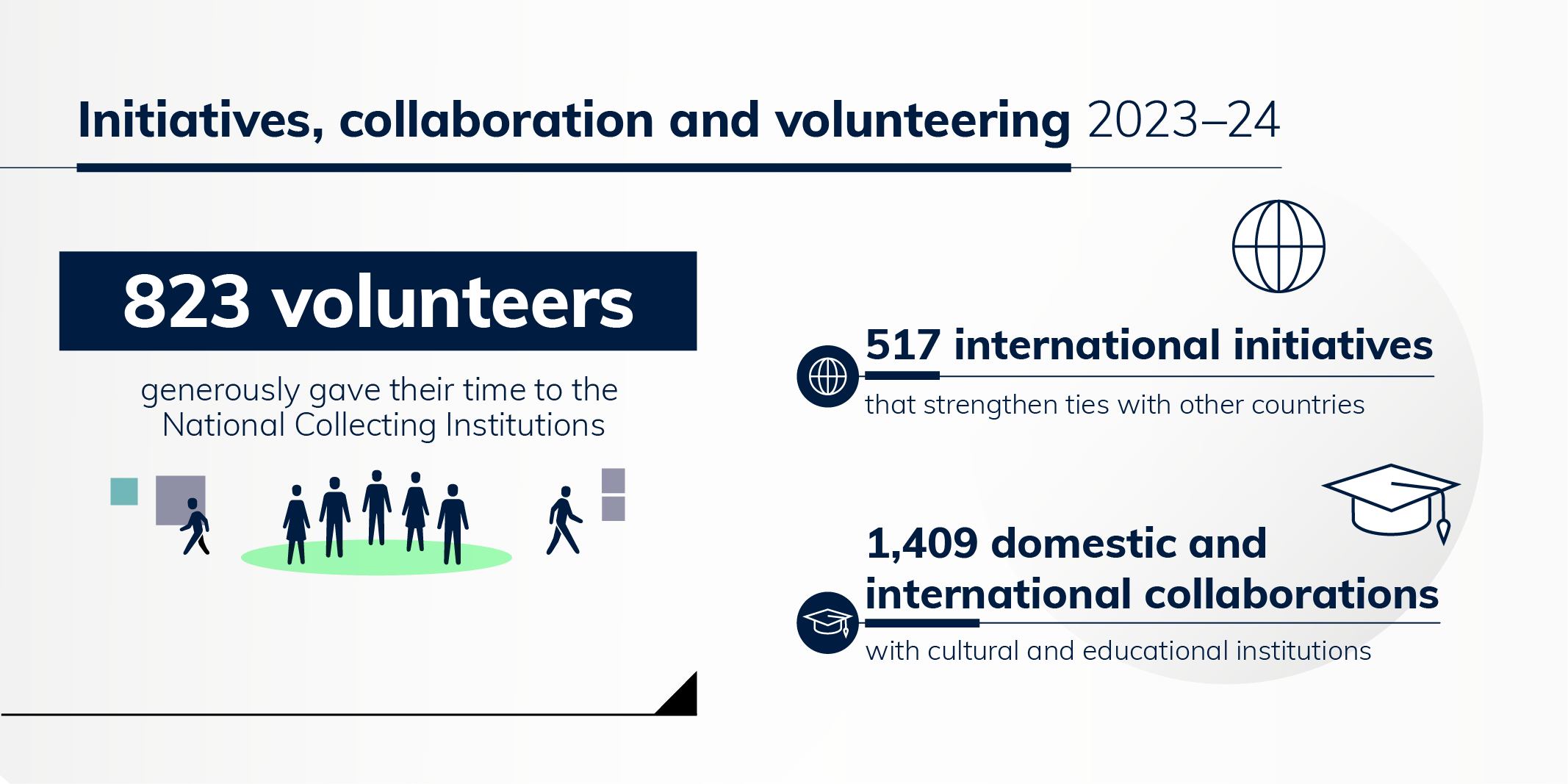

Impact of our National Cultural Institutions

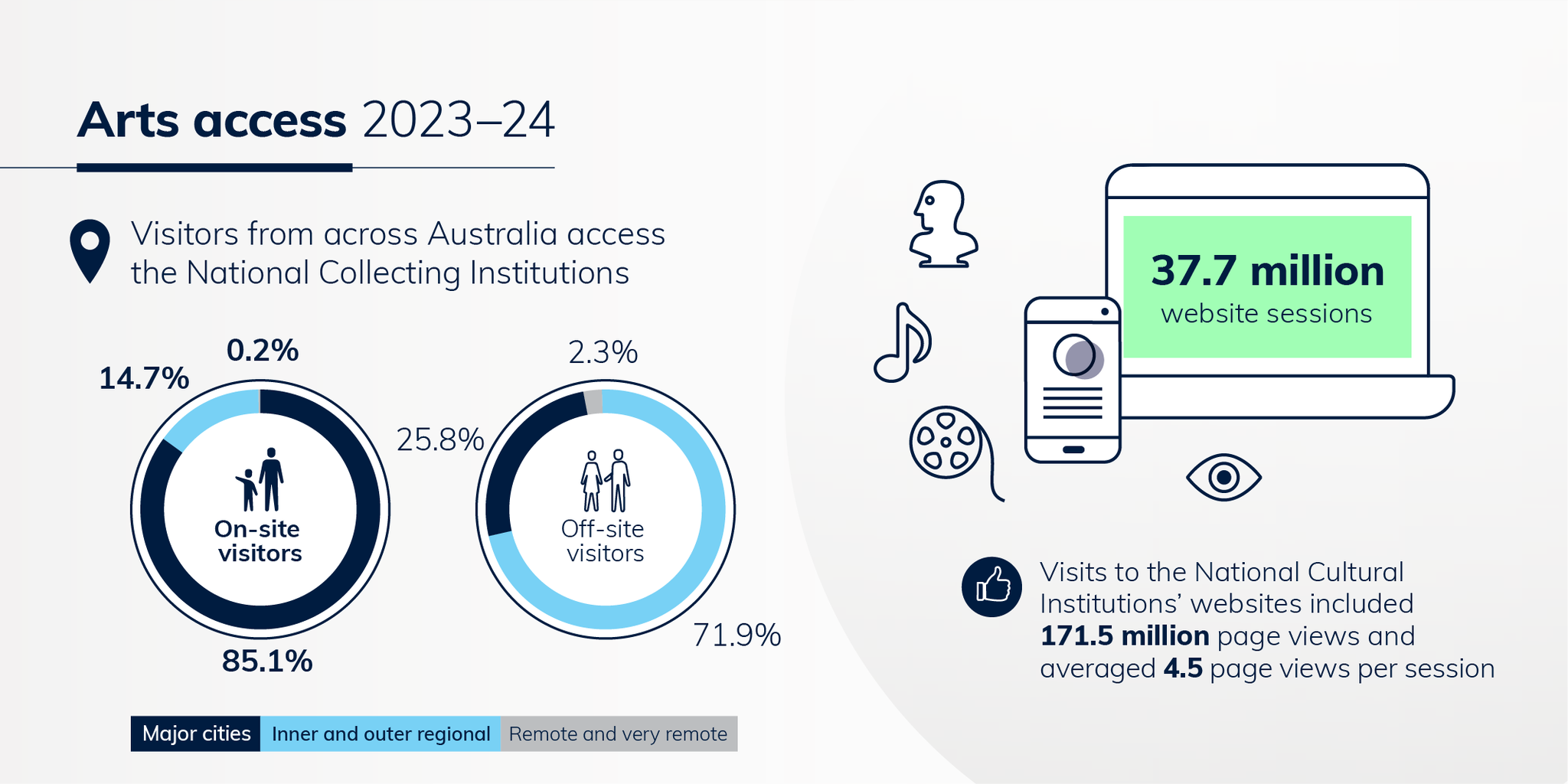

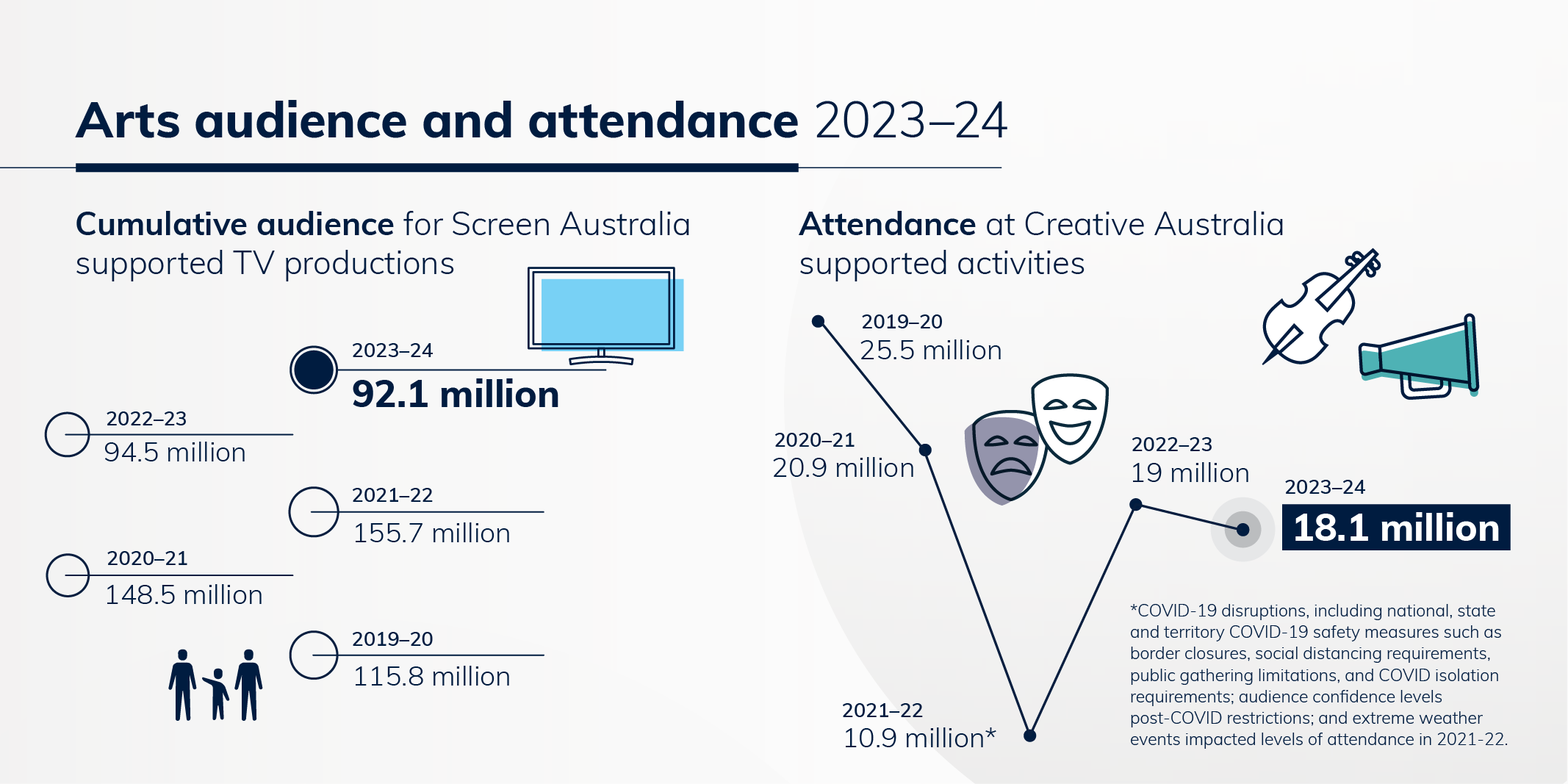

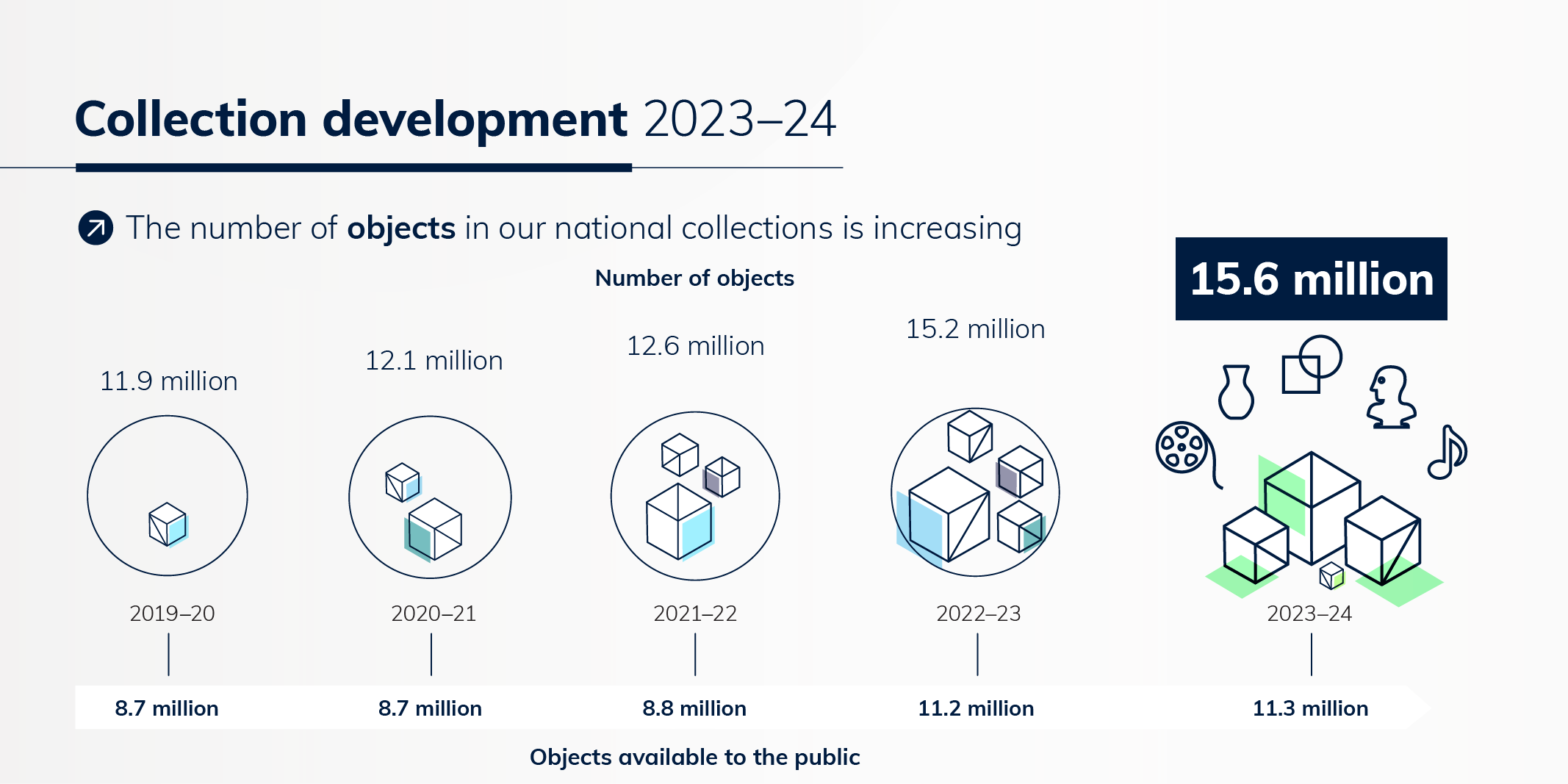

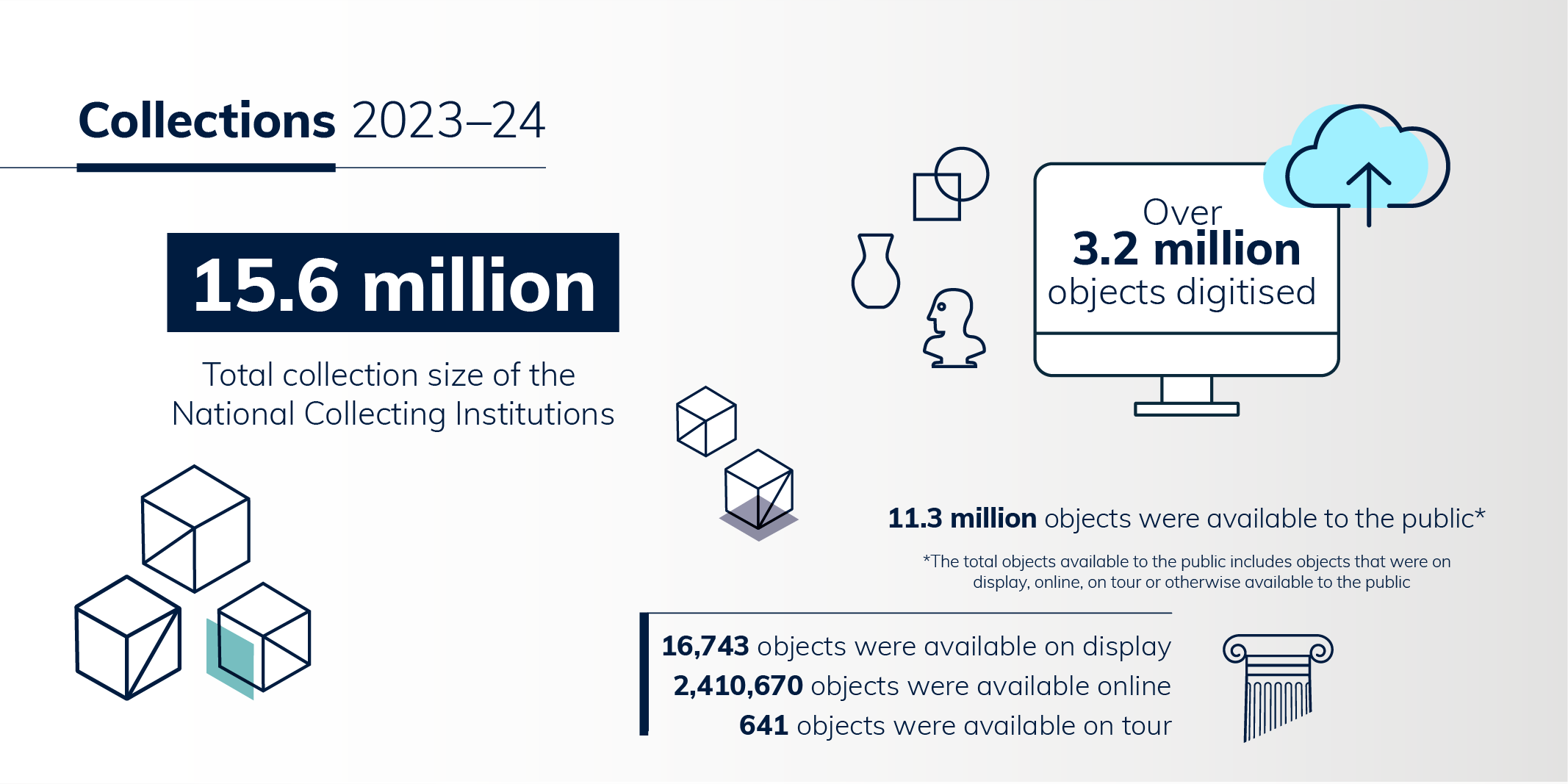

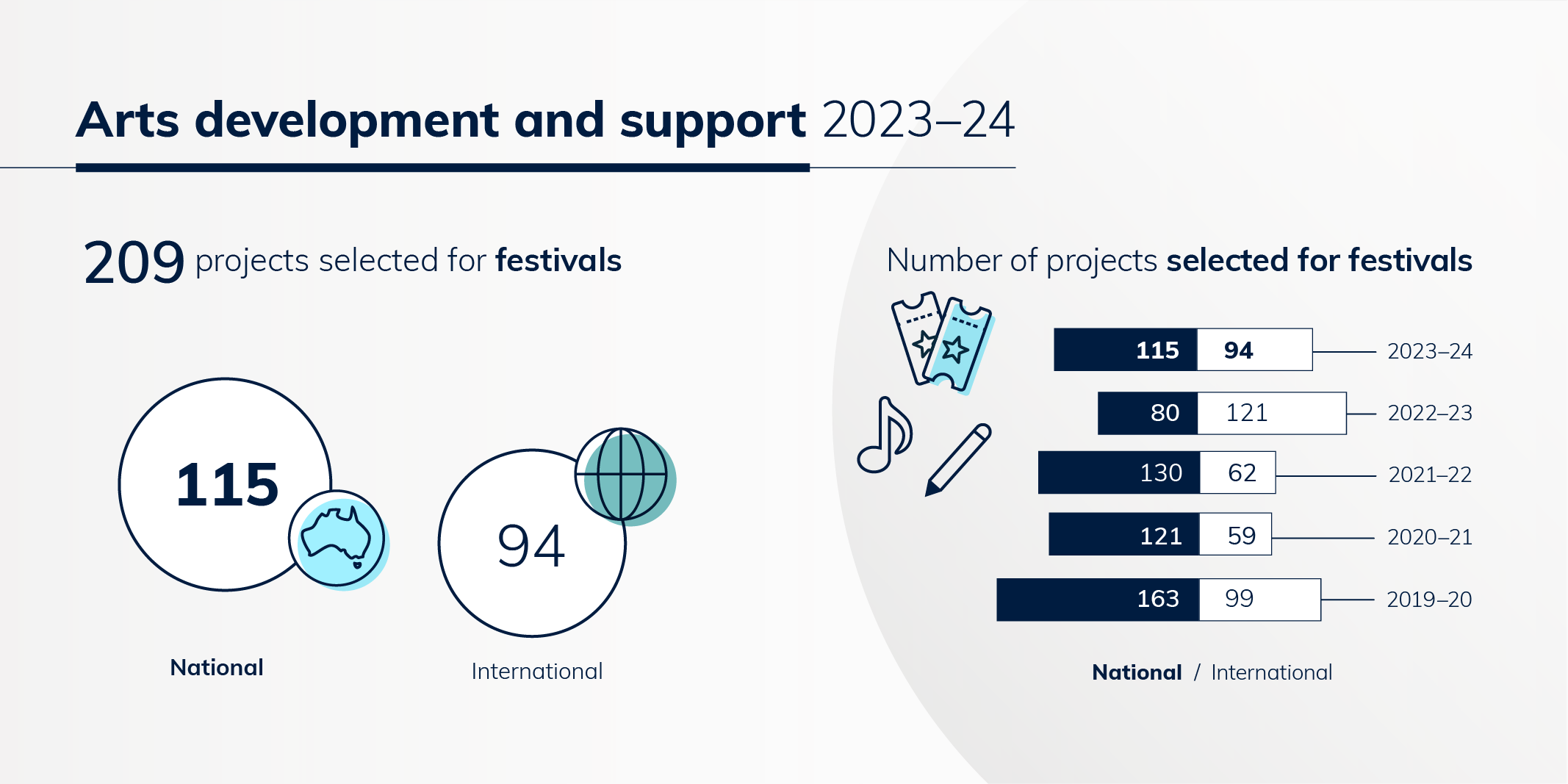

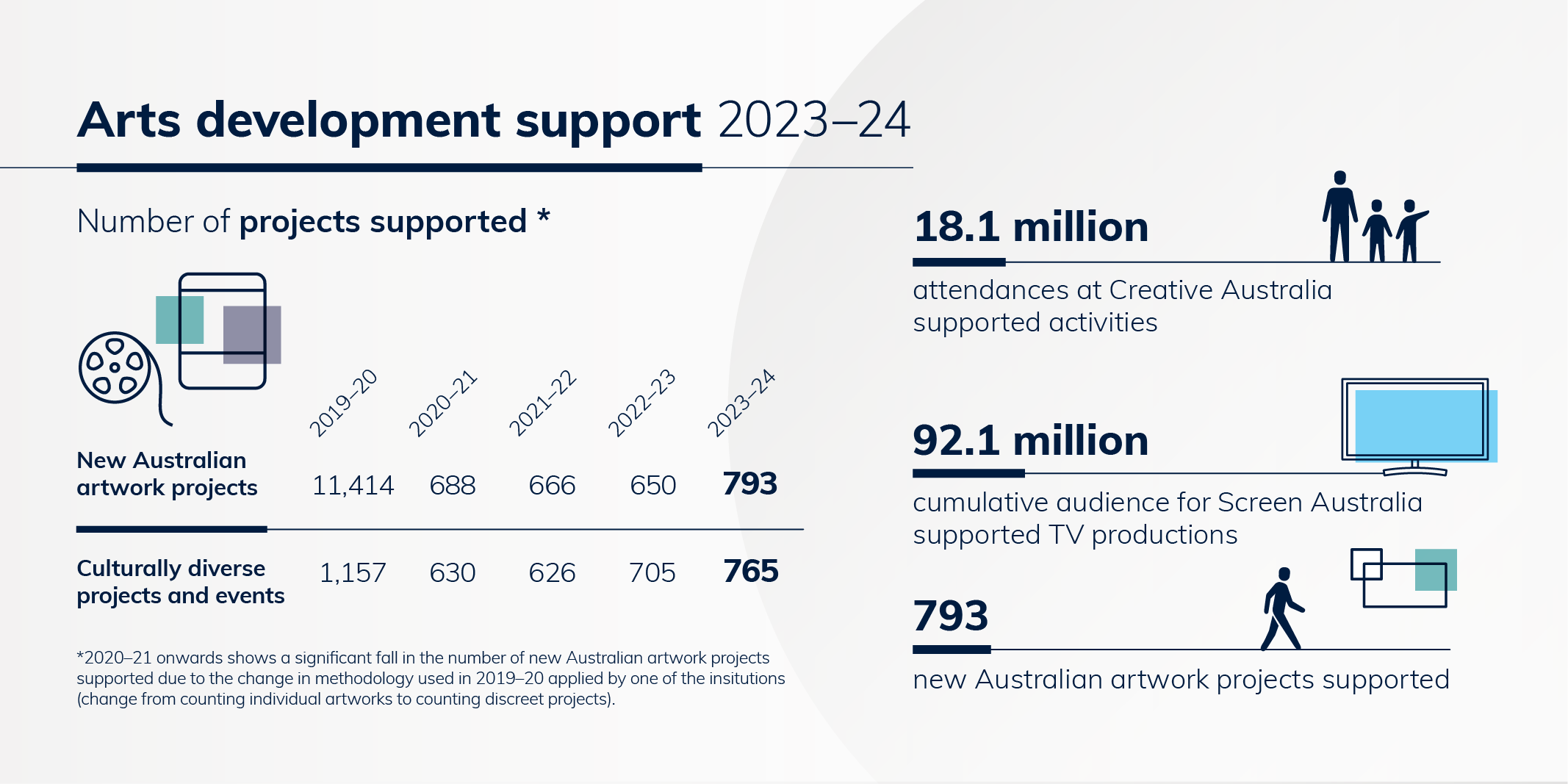

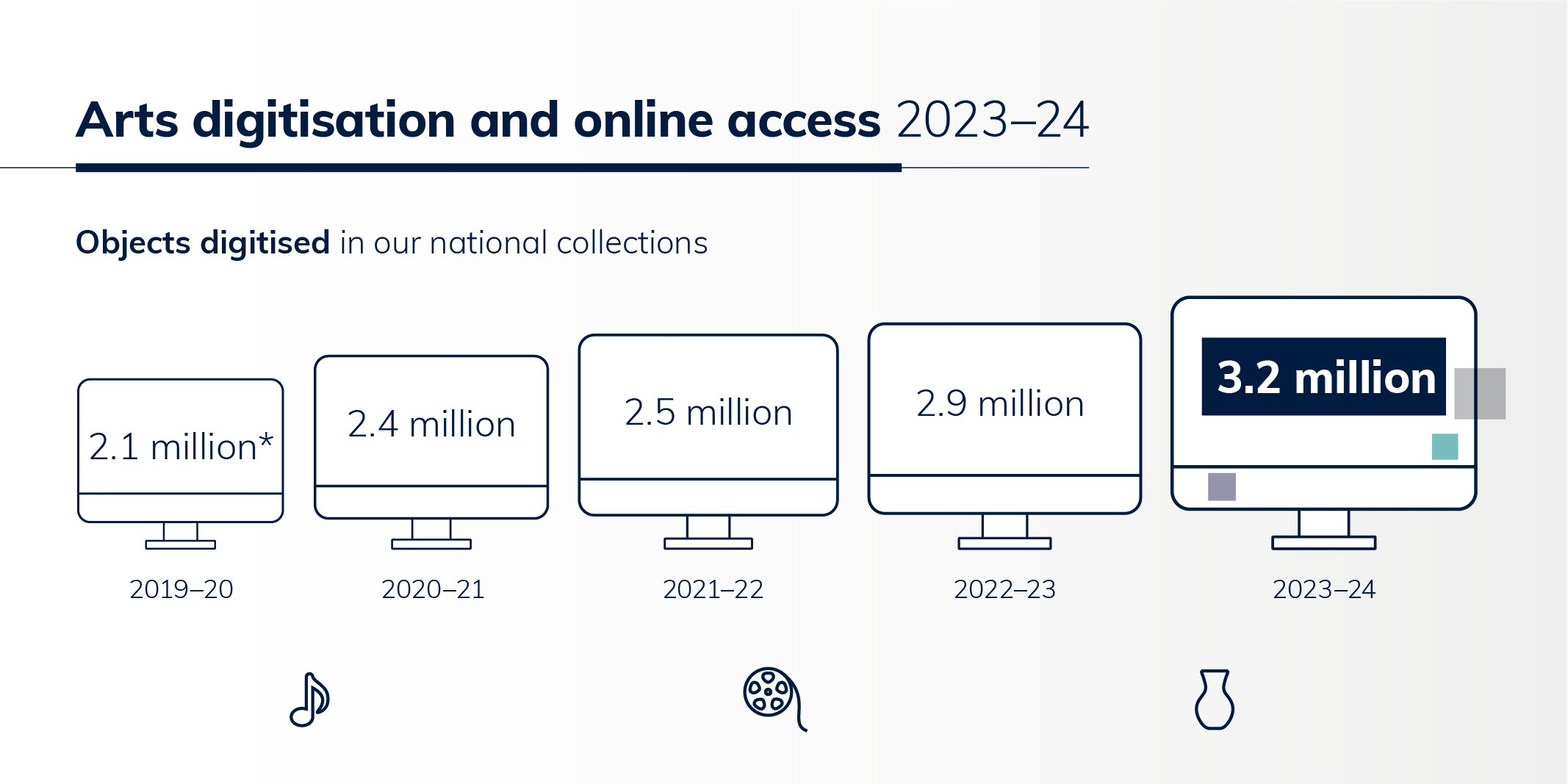

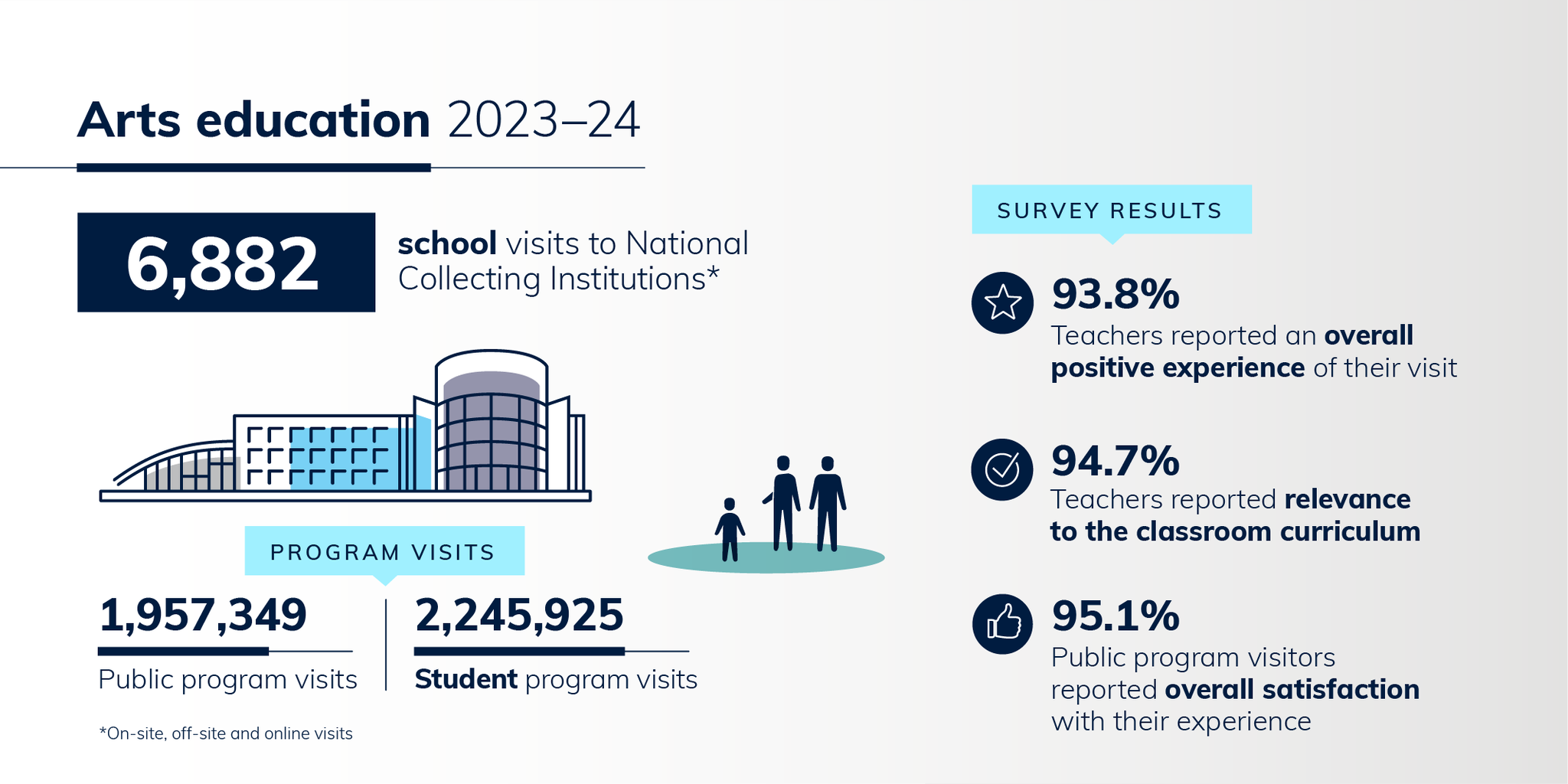

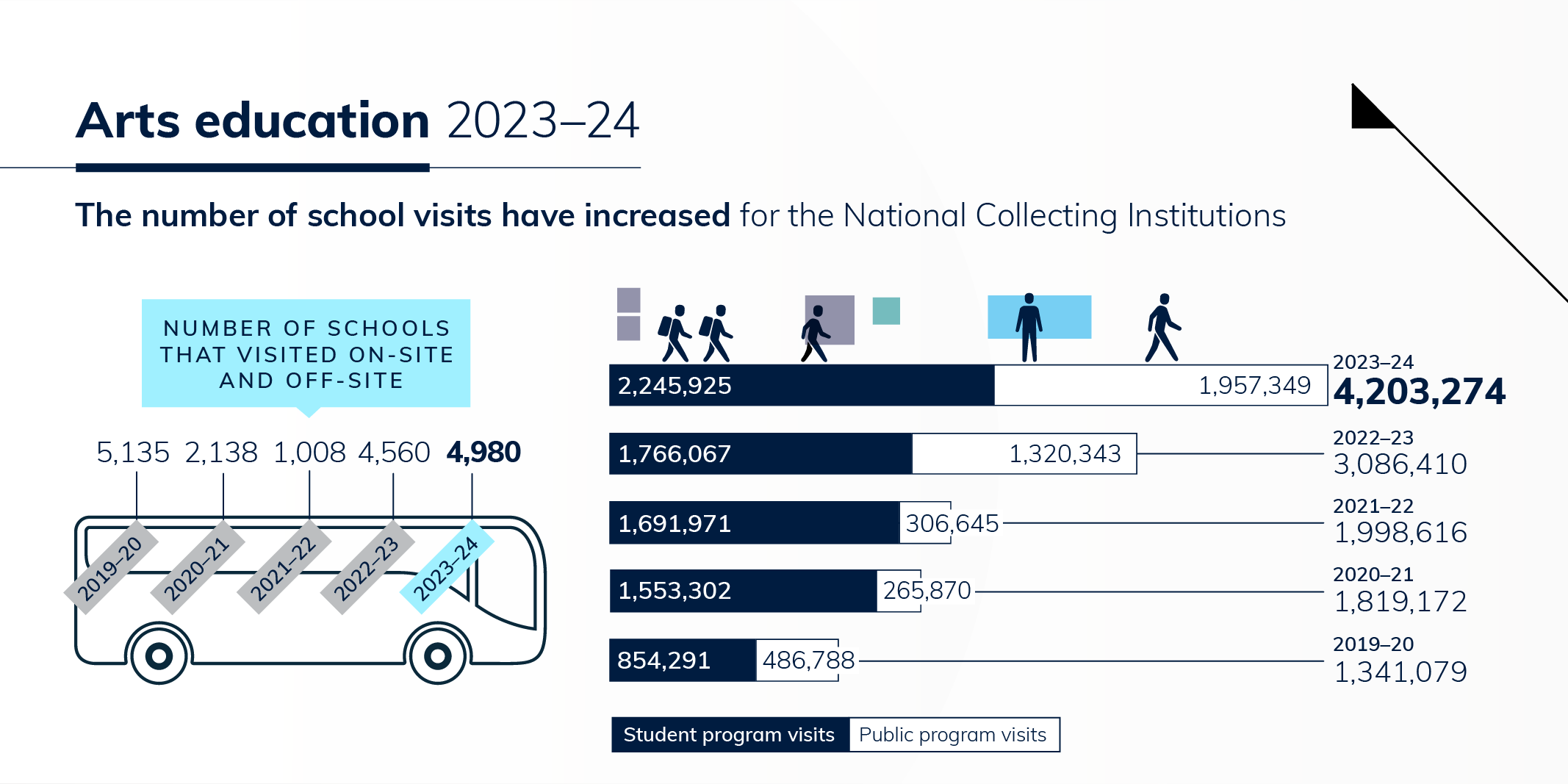

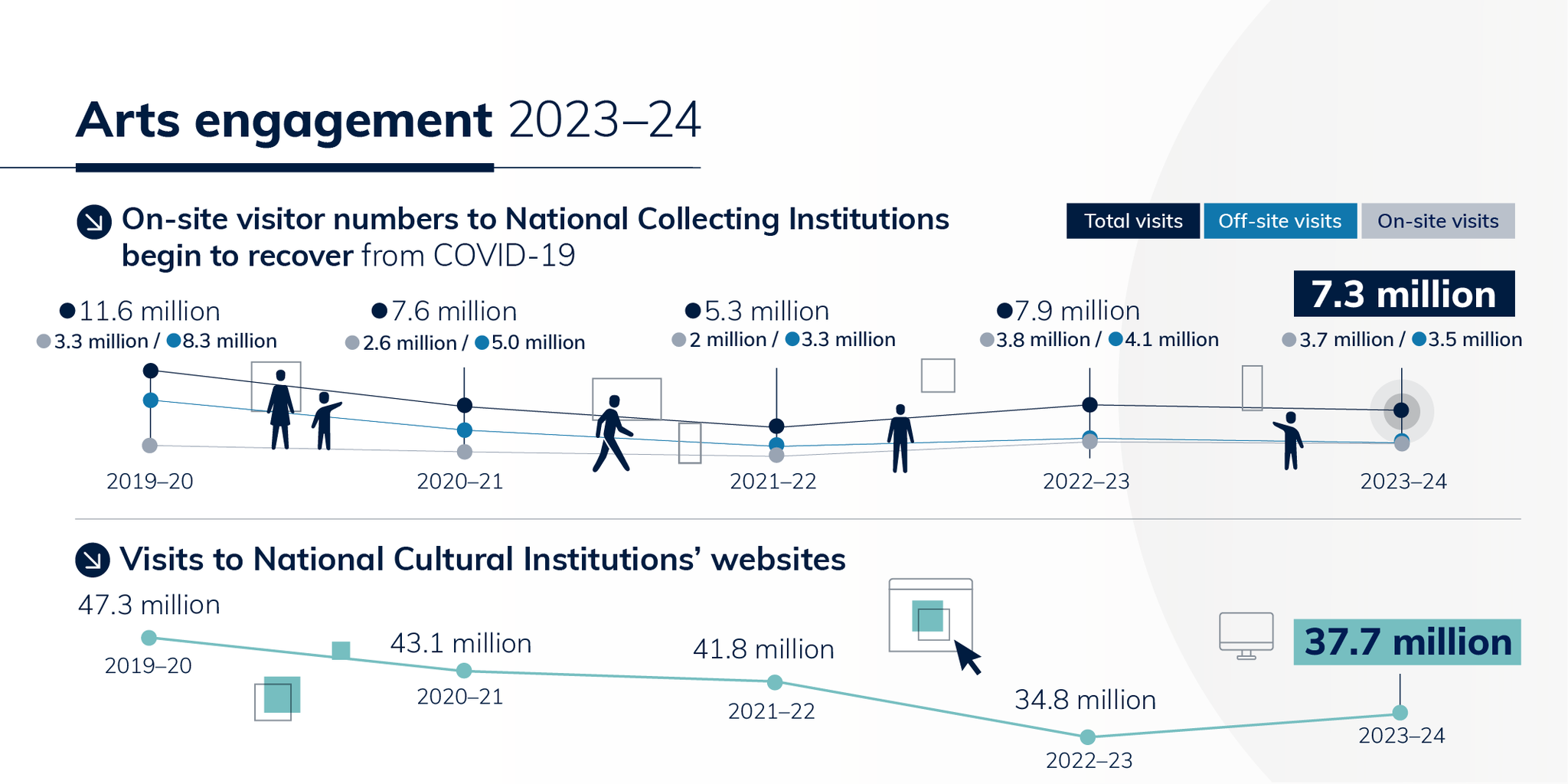

The Office for the Arts work collaboratively with the National Cultural Institutions to better understand trends in their activities. This is the 12th year this data has been captured, building a comprehensive picture of trends in visits, audience reach and educational programs over time.

In the 2023–24, the arts and cultural sector experienced several challenges primarily driven by changing consumer behaviour and uncertainty surrounding economic recovery post-COVID. The National Cultural Institutions were impacted by these sector-wide changes.

These infographics reflect the performance of the National Cultural Institutions in 2023–24.

2023–24 results

- National Cultural Institution KPI Infographics 2023–24—results and trends (including text version)

- National Cultural Institution KPI Infographics 2021–22—results and trends (including text version)

- National Cultural Institution KPI Infographics 2020–21—results and trends (including text version)

- 2020–21 results

- 2020–21 trends

- 2019–20 results

- 2019–20 trends

- 2018–19 results

- 2018–19 trends

The National Cultural Institutions are:

- Australian National Maritime Museum

- Bundanon Trust

- The Museum of Australian Democracy at Old Parliament House

- National Film and Sound Archive of Australia

- The National Gallery of Australia

- The National Library of Australia

- The National Museum of Australia

- The National Portrait Gallery

- The Australia Council for the Arts

- The Australian Film, Television and Radio School

- Screen Australia

Note: Creative Partnerships Australia also contributed to the 2021–22 national cultural institution data. From 1 July 2023, Creative Partnerships Australia's functions will be delivered through Creative Australia (formerly the Australia Council) following changes as part of the Australian Government's National Cultural Policy, Revive: a place for every story, a story for every place.

All National Cultural Institutions included in the 2021–22 data were within the Australian Government's arts portfolio in 2021–22, with the exception of the Museum of Australian Democracy at Old Parliament House. The Museum of Australian Democracy was part of the Department of the Prime Minister and Cabinet portfolio until July 2022, when it became part of the Arts Portfolio within the Department of Infrastructure, Transport, Regional Development, Communications and the Arts following Machinery of Government changes.

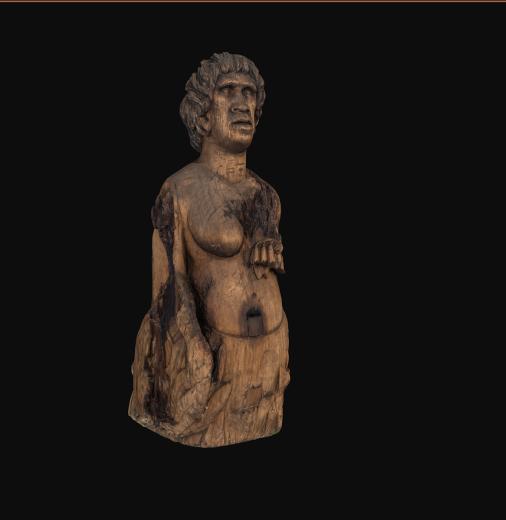

Domestic repatriation

The Indigenous Repatriation Program—Museum Grants (the Program) supports the return of Australian First Nations peoples' ancestral remains (ancestors) and secret sacred objects (objects) held in the collections of eight major Australian museums to their Traditional Custodians. The eight eligible major museums are: Australia Museum, National Museum of Australia, Museum and Art Gallery of the Northern Territory, Museum Victoria, Queensland Museum, South Australian Museum, Tasmanian Museum and Gallery and Western Australian Museum.

These eight museums are eligible to apply for funding under the Program to work in partnership with identified First Nations communities to return their ancestors and objects. The Australian Government recognises the importance and cultural significance of First Nations communities being directly involved in the repatriation process. It is estimated that more than 3,400 ancestors and more than 2,300 secret sacred objects have been returned to the custodianship of their Communities. Each museum funded under the Program is responsible for the management of their respective repatriation programs. 2024–25 grants are in place for seven of the eligible Museums.

Objectives for the Program are to:

- Identify the origin of ancestors and objects held in the collections of the funded museums.

- Empower First Nations communities to be involved in the repatriation of ancestors and objects.

- Repatriate ancestors and objects in the funded museums' collections to their Traditional Custodians.

- Facilitate discussion with Traditional Custodians for culturally appropriate storage and access to ancestors and objects.

- Support the engagement and/or employment of First Nations people to provide assistance, support and cultural advice to progress the repatriation of ancestors and objects to their Traditional Custodians.

On this page

2023–24 Museum Grant Highlights

2022–23 Museum Grant Highlights

2021–22 Museum Grant Highlights

Museums Repatriation Representatives Meeting

In April 2024, the Department hosted a national meeting of museum repatriation representatives in Canberra. The meeting provided an opportunity for repatriation representatives from the eight museums funded under the Program to workshop repatriation issues affecting First Nations people. Participants discussed a range of topics including temporary care arrangements, grants reporting and cultural objects on loan as well as ways to share knowledge and proposed repatriation activities and challenges for 2024–25. The key outcomes of the meeting were information sharing, improving collaboration and fostering best practice to better support First Nations communities to repatriate their ancestors and objects.

More information

For more information on the Program, email repatriation@arts.gov.au.

For more information about the respective museum repatriation programs and the return of ancestors and objects in their safekeeping, please contact the museums directly.

Participating institutions

Enriching Australia's public collections

The Cultural Gifts Program (CGP) helps make important cultural items accessible to the Australian public by providing incentives for donors to donate art and cultural property to Australia's public collecting institutions.

Public collecting institutions must be endorsed as a Deductible Gift Recipient (DGR) on the basis of being a public art gallery, museum or library (including archives) by the Australian Taxation Office (ATO). Institutions and donors are encouraged to familiarise themselves with the Cultural Gifts Program Guide prior to commencing an application.

Roles and responsibilities

The process of providing a donor with a tax deduction for a donation made under the Cultural Gifts Program begins when a participating institution accepts the donation into its collection.

The recipient institution is responsible for:

- Ensuring the donation meets the institution's collection policy, including undertaking due diligence in relation to ensuring it complies with all legal requirements.

- Accepting the donation into its permanent collection.

- The donor and institution must complete a Certificate of Donation. For large donations, please complete the large donations template.

- Assisting donors in obtaining at least two valuations for the donation from CGP approved valuers.

- Valuations will not be accepted under the CGP unless the valuer is approved for the relevant class. For example, a valuer approved for Australian paintings after 1950 would not be eligible to value an Australian painting dated 1890.

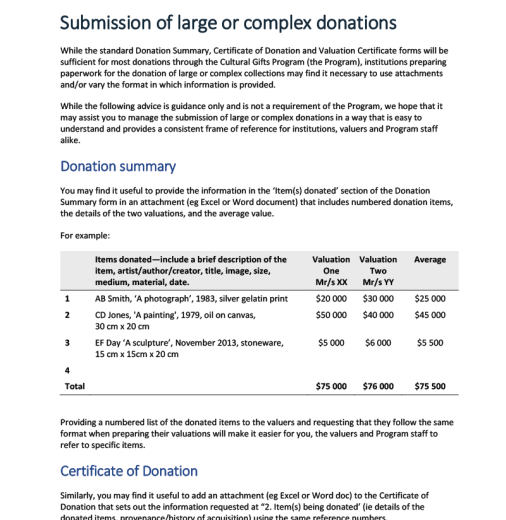

- Submitting the required documentation to the department using the online system. The Certificate of Donation and Valuation Certificates for donations made under the CGP must be submitted through the department's online submission portal: Start now. For collections of four or more items please upload a complete list itemising both valuations using the breakdown of items template.

- The department will notify the donor and the institution upon receipt of the application.

- The department will send the donor a letter once the application is finalised.

Acknowledging Australian Government support

Recipient institutions must acknowledge the Cultural Gifts Program when referring to donated items on materials including but not limited to promotional materials, websites, social media, invitations and signage.

The standard acknowledgement for a donation is:

- Donated through the Australian Government's Cultural Gifts Program.

Acceptable variations include:

- Donated through the Australian Government's Cultural Gifts Program by [donor's name].

- Donated through the Australian Government's Cultural Gifts Program by [donor's name] in memory of [name].

- Donated through the Australian Government's Cultural Gifts Program in memory of [name].

Deaccessioning

Donations should only be accepted on the basis that they will form part of an institution's permanent collection. However, the department acknowledges changes in collection policies may occasionally result in the need to deaccession items.

If items are removed from a collection, this should be done in accordance with the institution's deaccessioning policy. Donations under the CGP should not be returned to the donor as the donor has already received the benefit of the tax deduction for the gift.

Frequently asked questions

- Visit the frequently asked questions page for more information.

Museums, libraries and galleries

Australia's collecting institutions protect and celebrate Australia's rich cultural heritage, share resources and mentor regional partners. We provide advice to government and the sector on best practice for collecting cultural material, developing quality collections and ensuring ethical collecting in Australia

Latest news

Cultural Gifts Program valuers

Cultural Gift Program (CGP) valuers bring a depth of qualifications, knowledge, and experience in valuing cultural material to specific classes of material. The Cultural Gifts Program Guide provides detailed information about the role of valuers in the Program, as well as a detailed glossary of property classes. An up-to-date list of approved CGP valuers is here:

Applying to become an approved valuer

To value donations made under the CGP, you must be approved for this specific purpose by the Secretary responsible for the Arts, or their delegate. The CGP welcomes all valuer applications, with a current emphasis on the following classes of property:

- large technology objects, eg. cars, train carriages

- militaria, eg. uniforms, ensigns

- items relating to Oceania (excluding Australia and New Zealand)

- jewellery

- textiles

- tapestries

Should you wish to apply to become a valuer, please contact the CGP team in the first instance on cgp.mail@arts.gov.au to discuss your application.

To be approved, you must be nominated by a major public institution that collects material in the area of your expertise. Your application will need to include:

- The classes of property you are applying to be approved to value.

- Evidence of relevant experience relating to these categories.

- Two referee reports for each class of property from professionals who are qualified to comment on your expertise. At least one of these referees must be an appropriate specialist staff member from the institution that is nominating you.

- Copies of the Code of Conduct for Valuers and the Private Interests Assurance form signed by you.

- We may seek additional information from you during the assessment process.

You will need to complete the following forms and email copies to cgp.mail@arts.gov.au:

- Application for approval as a valuer

- Cultural Gifts Program—Valuer referee report

- Cultural Gifts Program—Nomination of a Valuer

- Checklist for new valuer applications

- Cultural Gifts Program—Code of conduct for valuers

- Cultural Gifts Program—Valuer Private Interests Assurance

Extending approved classes of property

If you are seeking extensions regularly, the department will ask you to apply to extend your approved classes permanently. You can apply to extend your classes permanently by emailing us with the details of your new categories. Once your new categories have been finalised with the CGP team, you should then seek reports from two referees for each class of property. As with your application to be a valuer, at least one of these referees should be a senior curatorial or administrative staff member from a participating institution that collects material in your new nominated categories.

One-off approvals

Occasionally valuers are asked to value items outside their approved classes of property. The department can approve a one-off extension to your approved classes in extenuating circumstances. For example:

- The item is part of a collection, and is closely related to your existing classes of property. You are already approved to value the large majority of items in the collection.

- The item is closely related to your existing classes of property, and it is impractical to engage a valuer who is approved to value the item.

Generally, the department will only grant a one-off extension where the item in question is closely related to your existing approved classes. If you need to seek a one-off extension, you must contact the department before you undertake the valuation. Retrospective approval cannot be granted. You can commence the one-off approval process by emailing the CGP team on cgp.mail@arts.gov.au Further information can be found at:

Frequently asked questions

- Visit the frequently asked questions page for more information.

Cultural exhibitions to shine throughout our regions